Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.

― Sam Ewing

Inflation is the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. As a result of inflation, the purchasing power of a unit of currency falls. For example, if the inflation rate is 7%, then a pack of food that costs ₹100 in a given year will cost ₹107 the next year. As goods and services require more money to purchase, the implicit value of that money falls.

Whatever returns compound interest generates, inflation degenerates it. Inflation is shrinking your money with compound interest, lets call it decompound interest.

Consider a situation where you invest Rs 1 lakh of your money in a deposit which earns you 8 per cent a year. At the same time, the prices are also generally rising at the rate of 8 per cent a year. In such a situation, your compounding returns will just about keep pace with the inflation. That means your ₹1 lakh values at ₹1 lakh even after one year.

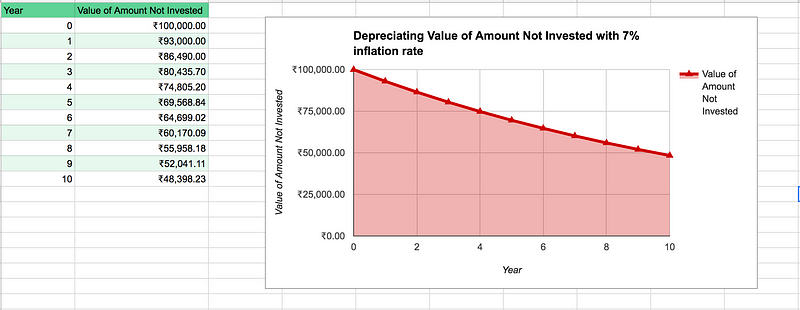

If you are an Indian reading this then India’s average rate of inflation over last few years was 7%. Consider a worst situation where you do not invest your ₹1 lakh and it do not earn you any return. In that case, after one year your ₹ lakh will get shrunk to ₹93 thousand rupees in first year and then to ₹86, ₹80, ₹74 thousand in subsequent years, considering 7% average inflation rate.

To summarize it more clearly, ₹10000 in 1982 is worth just ₹607 today.

If your lifestyle costs you some ₹xx,xxx amount today then calculate the amount you need to sustain similar lifestyle years from now, maybe your retirement years. And then count the amount you will need to save per month to actually sustain that lifestyle once you stop earning. So, if ₹1 crore sounds like the kind of money you’ll want twenty years from now then you’ll actually need to have about ₹4 crore. If you work backwards from there, you’ll need to save about ₹68,000 a month if the returns are 8 per cent.

That’s considerably huge amount, but it is! And there is no escape from the arithmetic. So you need a form of investment that’s inflation adjusted. If you really think you can survive with your bank FD, then think again.

Discover more from Vittartha

Subscribe to get the latest posts sent to your email.

“Inflation is shrinking your money with compound interest, lets call it decompound interest”. I was not thinking this way. It proves that compounding works in other direction also.