Note: This post is written considering Indian real estate market.

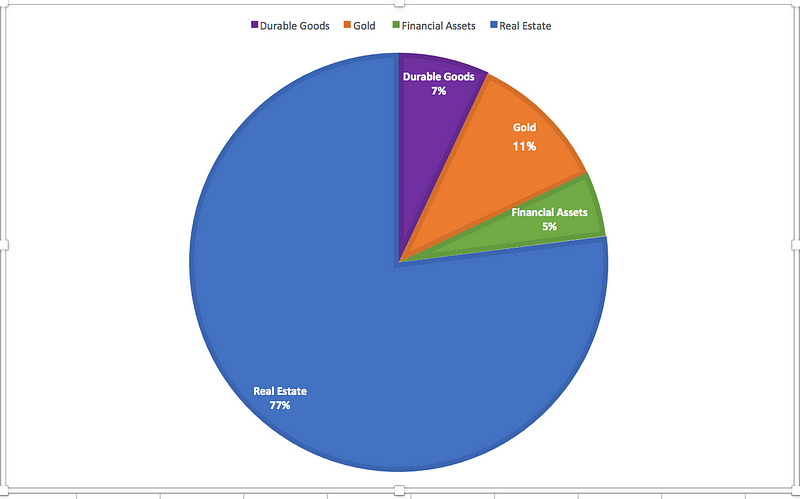

For Indians, owning a house is an ultimate definition of being successful. According to RBI’s Household Finance Committee Report 2017, only 5% of India’s household savings is invested in financial assets as against 77% in real estate.

During 2003–13, India saw a real estate boom. That helped establish real estate as an asset class by itself. There has been a continuous positive publicity given to this asset class in weekend newspaper supplements. There were regular TV shows on investing in real estate. And everyone had a ‘friend’, who has made a fortune with his third flat in Pune. Despite of all this positive publicity, real estate is a dangerous asset class for investors. We will see how?

Ticket Size: You can buy a stock for as low as ₹10 and a mutual fund for ₹500. But you need few lakhs upfront for investing the cheapest of the properties.

Liquidity: If you compare real estate with Stocks, bonds, MF, Gold etc. Real estate is an illiquid asset class. With a simple click on your smartphone, you can trigger a transaction to sell your stocks. However, selling real estate in itself is a complete project. There were instances when a process of selling a property went on for months and sometimes years.

Transaction Costs: Stamp duty, registration and other transaction charges exceed almost 10 percent of the cost of the property. Sometimes, developer or the housing society also charges transfer fees.

Taxation: Short term capital gains taxes on real estate are marginal. Long term capital gains tax is 20%.

Non Standard Asset: One gram of 24-carat gold will appreciate at the same pace in your hand as it will in the hands of someone else. It will appreciate at the same pace in Pune as it will be in Mumbai. Same is the case of any stock. However, if you consider real estate, it is completely non-standard. Two neighboring flats may not always get sold at the same price. Prices vary across streets and neighborhood. And beware, if the word spreads that your flat is haunted by ghost, then it won’t ever see a buyer. 😁

Black Money: Real estate have always been a darling asset class to park the black money. It is one of the least clean sector in India. The multitude of clearances required to buy a land, build and then sell it makes it an ideal sector for bribery and black transactions. In such case, a middle class investor who holds complete white money, pays his taxes is always the last person to benefit from real estate investment.

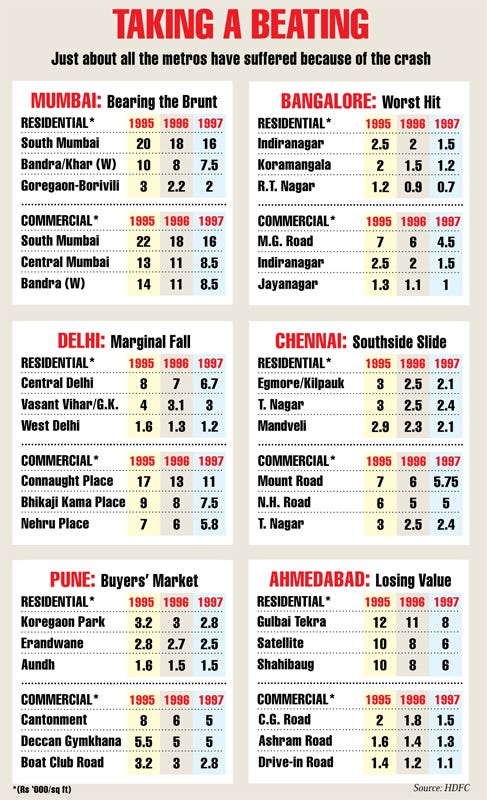

House prices don’t always go up: Usually equity and debt have a cycle of three to five years. i.e. within a cycle of 3–5 years you may witness a full cycle of bear and bull market. Such cycle occurs in real estate for more than ten years. So the most of the people who reaped the profits during bull cycle of 2003–13, don’t have any experience of downward cycle. As a result, they get caught in the belief that real estate prices only go up. Unfortunately, in India there are no reliable real estate prices indices. So this myth prices always going up is nurtured due to lack of any solid evidence.

There was an article in India today in 1997, which neatly explained the real estate crash of nineties.

Magnificent returns don’t last forever: Yes, 2003–13 real estate bull market generated magnificent returns during that period. However, there were certain downsides too. Even if the property you purchased appreciated significantly, if it’s your occupied home, it is impossible for you to book the profit. 2003–13 was the best period for residential real estate in India, and it will be a long time before we see another such period of price appreciation. Till that, the unrealized gains buyers made will be corrected to normal due a bear phase.

Holding Period: Real estate is usually held for very long period of the time. Nobody buys a real estate and checks it’s price every single minute. That happens with the stocks, bonds and gold. It is very well proven that stocks if bought right and held tight generate humungous returns over very long period like a decade or more.

And most important factor:

Bad Maths: It is very common for real estate investors to boast about his property going up by five times in the last twenty years. But the compounded annual return it generated is merely 8.3%. In the same period, the Indian stock market is likely to have risen at 15% per annum. Which compounded over 20 years translates to a sixteen times return.

So if you are thinking of putting your money into real estate, these points should be taken into consideration. Closely looking at current real estate market, it is clear that the bull run is over. Even if India do not witness a real estate market crash, it is quite unlikely that they will go up in any meaningful manner. A phenomenon that call it a Time Correction.

Discover more from Vittartha

Subscribe to get the latest posts sent to your email.