If you are looking at different options to invest your money, the mutual fund is often a most attractive form of investment vehicle. With increasing awareness about stock markets and mutual funds, more and more people are starting to invest their money in MFs. However, there is a steep learning curve in understanding mutual funds. A wrong decision may bring unpleasant experience. A wrong expectation may spoil the planning.

Here through these series of articles, I will try to explain mutual funds in details. These articles may help you in learning the basics of investing in mutual funds, choosing the right fund that suits you, setting and achieving financial goals.

What Are Mutual Funds?

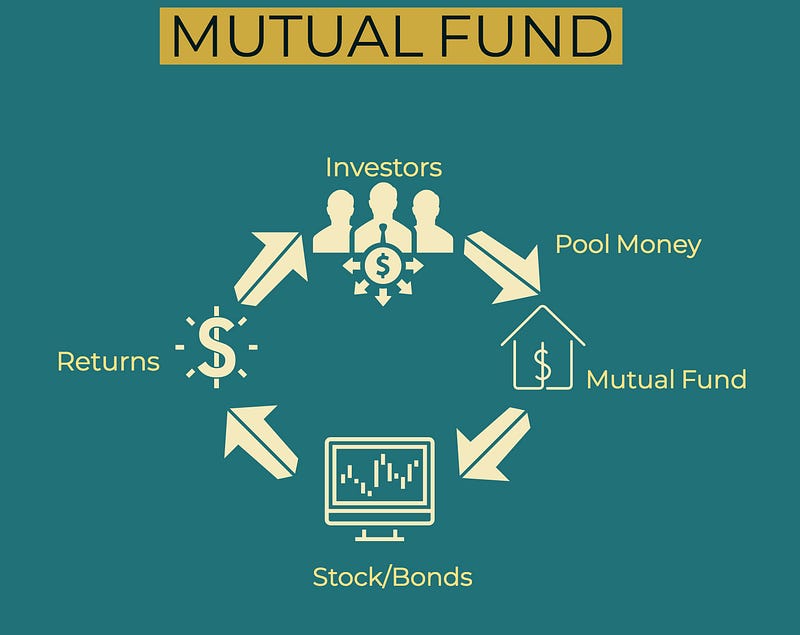

A mutual fund is an investment company that takes money from multiple investors and pools it together. The fund manager invests the money in different types of assets including stocks, bonds, gold. We, as an investor buy the mutual fund units. These units represent an ownership interest in the fund.

Investor: He who invests in a mutual fund.

Fund Manager: An employee from mutual fund company who manages the investment of money on its behalf.

How mutual fund company makes money?

When you read mutual fund fact-sheet, you may find one component named as Total expense ratio (TER), it is associated with the total costs involved in managing a mutual fund. These costs include fund management fees, operational expenses, administrative expenses and distributor commission. So you should always look at TER while choosing MF. TER is deducted from every investor’s investments.

What are the benefits of investing in a mutual fund?

Investing in a mutual fund is like hiring a professionally trained driver to drive your car, sitting on a back seat and enjoying the journey. While your driver drives the car for you. In the case of mutual funds, the fund manager is your driver.

Mutual funds are managed by a professional fund manager who constantly monitors the fund’s portfolio. Because this is his or her primary occupation, they can devote considerably more time to selecting investments than an individual investor. It provides the peace of mind that comes with informed investing without the stress of analyzing financial statements or calculating financial ratios.

Increased diversification: A MF diversifies by holding many shares. This diversification decreases risk.

Liquidity: Most mutual funds allow investors to redeem their MF units any time they wish. (Although it is recommended to hold them for the longer period and take exit loads (if any) into consideration while redeeming MFs.

Professional investment management: Mutual funds hire portfolio managers to supervise the fund’s investments.

Ability to participate in investments that may be available only to larger investors. For example, individual investors often find it difficult to invest directly in foreign markets.

Government oversight: Mutual funds are regulated by a governmental body.

Transparency and ease of comparison: All mutual funds are required to report the same information to investors, which makes them easier to compare to each other.

Discover more from Vittartha

Subscribe to get the latest posts sent to your email.