Direct Mutual Fund Vs. Regular Mutual Fund & their expense ratios

Mutual funds are available with two plans: Direct and Regular.

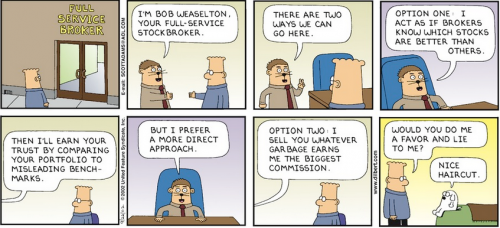

Regular Plan: When you buy a mutual fund through a mutual fund broker, distributor or advisor, it is called a regular plan. In case of a regular fund, the fund house pays commission to the middleman. The MF company will add this commission to the expense ratio. This is why regular funds are slightly more expensive than direct funds. The commission is deducted every trading day.

Direct Plan: In the direct mutual funds, there will be no role for intermediaries commonly known as brokers. Investors are free from commission or distribution fees, which brings down the expense ratio.

Expense Ratio

The expense ratio of a mutual fund is the total percentage of fund assets used for administrative, management, advertising, and all other costs. An expense ratio of 1% per annum means that each year 1% of the fund’s total assets will be used to cover costs.

The expense ratio of direct plans is significantly lower than regular plans. And investors should always take this into account.

Illustrations to help you understand expense ratio:

1.

Suppose there are 200 trading days in an year & MF’s expense ratio is 2.5%. So expense ratio per day becomes 2.5/200 = 0.0125%. Suppose on any trading day, the mutual fund has gained overall 0.30%. You NAV on that day will increase by 0.30–0.0125 = 0.2875%. Similarly, if the mutual fund decreases by 0.30%, your NAV will decrease by 0.3125%. Per day, 0.0125% seems a very small number, but in the long run, it becomes substantial.

2.

Aditya Birla Sun Life Tax Relief 96 Regular Plan has delivered 19.60% CAGR in five years, with an expense ratio of 1.92%. And the direct plan of the same fund has delivered 20.64% CAGR, with an expense ratio of 1.07%. (As of writing this post.)

So the direct plan has a 0.85% less expense ratio.

Suppose, you invested 10 Lakh in this fund for five years. Then at the end of five years, the value of your fund might have been:

Direct Plan: ₹ 25,55,386

Regular Plan: ₹ 24,47,123

So, there is a difference of ₹ 1,08,263. You earn this much less by investing in the regular plan.

So buying a direct plan can reduce operating expenses of the fund. And it can add more returns to your bucket. Also keep in mind that expense ratio also compounds with time.

Discover more from Vittartha

Subscribe to get the latest posts sent to your email.